Why the Federal Reserve is making everything more expensive in order to make things less expensive

It seems like a contradiction: How would increasing the cost of monthly credit payments actually help bring down the price of goods and services in the economy?

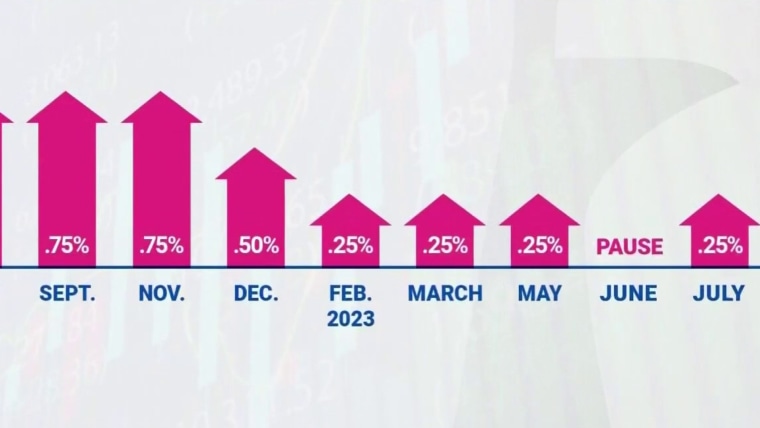

But that is the logic Federal Reserve officials are taking as they raise interest rates to 5.5%, their highest point in more than 22 years, in order to combat a pace of inflation that Fed Chair Jay Powell said Wednesday remains “much too high.”

As Americans are now well aware, the cost of seemingly everything — hotels, cars, dining out — has gone up at a pace the Fed is deeply uncomfortable with.

“My colleagues and I are acutely aware that high inflation imposes significant hardship, especially on those least able to meet the higher costs of essentials like food, housing, and transportation,” Powell said.

How the Fed is thinking about inflation

By making it more expensive for consumers and businesses to borrow money, it hopes to reduce overall economic activity — too much of which tends to cause inflation.

“We do want to see demand running below potential for a sustained period to create slack and, and give inflation a chance to come down,” Powell said.

It’s a trade off: Raise costs now, so that consumers and businesses don’t expect prices to go up in the future.

“If you fail to deal with it in the near term,” Powell said of inflation, “it only raises the cost … of dealing with it later to the extent people start to see it as just part of their economic lives,” Powell added, suggesting that a high level of inflation — which is anything above 2% — could become entrenched, making it harder to pull down.

For the average consumer, that means higher credit card interest rates, higher auto loan rates, and higher mortgage rates. It some cases, it means being denied when you apply for new credit, said Mark Hamrick, Washington Bureau Chief for the finance website Bankrate.

‘Medicine’ for the U.S. economy

Hamrick calls the higher interest rates “medicine” designed to target inflation. He acknowledged that not everyone, including central bankers, understand exactly how the higher rates work their way through the economy because those costs can manifest in many different ways, but there remains “a high degree of confidence” that the higher rates do help reduce inflation.

For businesses, the higher interest rates also mean it costs more money to borrow money, thus making it tougher to hire people and invest.

“That is an unfortunate fact,” said Derek Tang, an economist, cofounder and CEO at Monetary Policy Analytics/LHMeyer, a Washington, D.C.-based research firm.

The way the Fed is bringing down inflation, Tang said, might cause workers to experience fewer or lower raises, or even lose their job outright.

“On a human level, that hurts the poorest the hardest, because they already have less savings to draw on, because they’re also facing higher inflation and have to spend more on essentials like food, housing, and gasoline,” Tang said. “So really, there are no easy answers here.”

Ideally, the cost to people’s jobs due to higher interest rates will be minimal. And, so far, there’s been little significant impact to employment since the Fed began its current rate-hiking cycle in March 2022.

Notably, the unemployment rate, at 3.6%, remains at historic lows. Meanwhile, inflation has come down for 12-straight months.

This is what the Fed has sought all along. But Tang said the Fed hopes to make sure that inflation comes down — and stays down. Specifically, the Fed wants to see year-over-year price increases at 2%.

“The inflation rate is not low enough, not yet at the target the Fed wants it to be,” Tang said. “It needs to be confident it will be at that level in the future.”

Powell has acknowledged the difficult choice the central bank faces, but that for now it remains focused on wrestling down price increases, even if it comes with other costs.

“Restoring price stability is just something that we have to do,” Powell said Wednesday. “There isn’t an option to fail to do that because that is the thing that enables you to have a strong labor market over time. Without restoring price stability, you won’t be able, over the medium and longer term, to actually have a strong … sustained period of very strong labor market conditions,” Powell added.

And with a stronger labor market comes a more resilient economy, as long as the central bank can keep inflation in check.